Send invoice file

This page gives you the opportunity to send your debtors’ invoices to Intermarket as data file.

ø Attention:

- It must be made sure that only one currency and only one VAT rate can be used for every total of receivables.

- This file can either be sent to Intermarket in EXCEL or in CSV or in ASCII format.

- However, the following needs to be kept in mind:

In order to enter the data into the Intermarket system, please mind the record layout that corresponds with a predefined logic which needs to be respected in any case.

Assistance for setting up the invoices:

ASCII-format

EXCEL-format

CSV-format

How to send your invoice files to us:

- Click the button “Durchsuchen”. Then choose the file of your system that you wish to define as source folder.

- The name of the selected invoice file shows up in the field “Source folder”.

- Insert the batch number (2-digit) for the total of receivables into the relevant field.

- Then insert the total invoice amount and sum of credit notes (with a minus, as e.g. –3,528.36) and choose the VAT rate as well as the currency code by clicking on the flash of the field. Please mind the instructions to be found in “Attention”!

ø Attention:

- In the ASCII format you are given the opportunity to choose among a) and b) as stated below.

- As regards the EXCEL and CSV format, please only use b) as stated below

a) Please place the invoice amount and the sum of credit notes respectively on top of the combined rates of invoices in your invoice file. In this case the relevant fields “Total of invoices” and “Total of credit notes” need not necessarily be filled in.

b) Please insert the “invoice amount and sum of credit notes” respectively in the appropriate field.

Specifications and sums of credit notes always need to be made with a leading minus (e.g. –3,528.36).

5. In order to send invoice files, please click the button “Send Invoice File”.

Please note that only one invoice file can be sent to Intermarket at a time.

After your data have been processed by Intermarket, you can access menu “Download invoice record”.

TERMS OF PAYMENT

Please inform us on your general terms of payment at the beginning of our cooperation.

In case a deviating decision is made for a specific debtor, this can be determined in the section “ENTER NEW DEBTOR” under the heading “Individual terms of payment”

In case the deviating decision only refers to a single invoice, please inform us in the invoice file as follows:

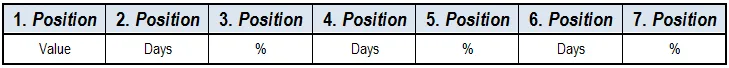

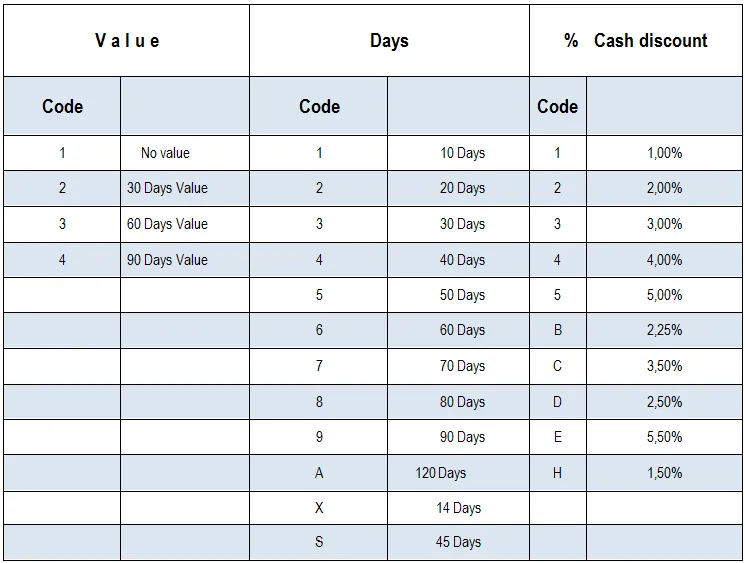

The indications of the terms of payment are made in form of a seven-figure code:

The first figure indicates the selected value, the figures 2 to 7 are structured into days-percent-days-percent etc.

Accordingly, the term of payment: “Due date starting with the issuing of the invoice, within 10 days: 3% cash discount, after 30 days: 2% cash discount, after 60 days net” is coded in the following

1 1 3 3 2 6 0

The code 2 X 2 3 0 0 0 thus means: 30 days value, payable within 14 days with a 2% cash discount, after 30 days net.

All codes are listed below